Does the US Have Carbon Credits?

admin

- 0

US Have Carbon Credits

Regardless of whether you’re a climate change proponent or a climate change skeptic, you’ve probably heard the term “carbon credit” thrown around. Typically, these credits are used to offset the greenhouse gas emissions of a company’s industrial production. However, they can also be purchased by individuals, businesses, and even organizations that are working to reduce their carbon footprint.

A carbon.credit is a type of a “permission slip” that allows a company to emit a certain amount of carbon dioxide and other greenhouse gases. The number of credits issued each year is determined by the company’s emissions targets. A company that exceeds its annual cap will have to buy additional credits.

There are two main types of carbon markets in the U.S.: a voluntary and involuntary market. The voluntary market is a system for companies to offset their greenhouse gas emissions through purchase of carbon credits. The involuntary market is set by regulators. These regulators have established a cap on the amount of carbon dioxide a company can emit. In some cases, the cap is gradually decreased over time. This is called a “cap and trade” program.

Does the US Have Carbon Credits?

One example of a cap and trade program is the Regional Greenhouse Gas Initiative (RGGI). Twelve states account for over a third of the U.S.’s population and GDP. These states have all successfully implemented a carbon-pricing program. The law will require the states to reduce greenhouse gas emissions by a specified percentage by the year 2025. The state’s cap is then reduced annually until 2050.

The State Department has recently proposed a new program to help low-income countries meet their international climate pledges. This initiative would create carbon credits to sell to private investors. The plan hasn’t been fully developed, but the Department says it will use a third-party certification process. The credits created by these transactions would provide a reliable source of funding for low-income nations.

The United Nations Development Programme provides advice to governments on how to produce carbon credits. It is part of a larger global effort to protect the environment. The UN also works to combat climate change by targeting corporations with what they call “dishonest climate accounting” practices.

The first international carbon markets were created through the Paris climate agreement. These include the Verified Carbon Standard (VCS) Program, the largest and most popular crediting system in the world. The VCS works to drive finance to activities that decrease emissions and support the livelihoods of people. The program includes a registry system to keep track of the projects it has approved. Its most popular accounting methodologies are geared to the project’s specific type.

The EPA has also recently adopted new standards for carbon credits. This includes the creation of quality credits and the adoption of a new rule book. Several major industries have already adopted net-zero or near-zero targets for their emissions. Among them are tech companies, airlines, and oil and gas majors.

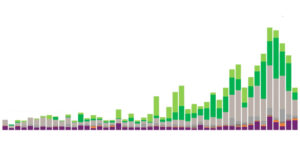

The growing demand for carbon credits has accelerated the voluntary market. These projects are often larger and easier to certify. Those who want to reduce their carbon footprint can buy credits directly from carbon capturers or from middlemen who are aware of the carbon markets.